The maturation and advancement of derivatives trading is a strong indicator of a maturing DeFi ecosystem. Most derivatives products offer an entirely new suite of opportunities for sophisticated traders who might want to interact with the DeFi market, but may not want to worry about the custody of their assets. The perpetuals market in DeFi currently stands at a mere $1.24B - which is still dwarfed by its counterpart derivatives market in traditional finance valued at a whopping $1 quadrillion!

As tiny as this market may seem, there are new decentralised protocols emerging that are aiming to expand the market share. But there is only one that has the ability to take on the more heavyweight centralised champions - and that is GMX.

In this piece, we’ll briefly explore how GMX is different and how its V2 upgrade is a

game-changer for the entire perpetuals market in DeFi.

Conquering the Market: GMX

One of the reasons why GMX stands out from other protocols is that it lets users open leveraged trading positions via a much-simplified user interface - one that’s mostly offered by centralised exchanges. Since the protocol relies on Chainlink Oracles, it smoothes out price fluctuations helping avoid temporary liquidation risks.

GMX is fueled by its underlying multi-asset pool known as GLP, which consists of 50-55% stablecoins, 25% ETH, 20% BTC, and 5-10% other assets. GLP is minted when users deposit their liquidity to the protocol. By simply minting GLP, LPs accrue 70% of all the fees that the protocol processes. This fee is accrued on traders when they open and close positions on the platform and also includes a borrow fee that is hourly charged.

In addition, holders who stake their GMX tokens also get 30% of all the fees that the GMX protocol processes. In return for staking GMX, users get esGMX which can either be staked for more rewards or be vested across a period of 12 months for $GMX.

The GLP pool acts as a counterparty to traders on the GMX exchange, which profits off the back of losing traders and vice versa. When the GLP pool makes a profit, GLP holders make a profit.

GMX outcompetes by allowing traders to take up to 50x leverage without losing any profits to slippage and/or losses due to impacts on token prices - all while retaining full custody over their assets.

Composability is the biggest weapon that has favoured GMX's unassailable growth. The margin trading volume on GMX over the past few weeks speaks volumes on its adoption.

That said, while GMX V1 helped the protocol amass a dominating market share, the V2 upgrade puts it at the centrefold of the DEX vs. CEX fight in the perpetuals arena. Let’s understand how.

What V2 Achieves

GMX V2 is an upgrade to GMX that puts it right at par - if not put it head to head - against centralised exchanges. This is possible thanks to the protocol’s focus on providing the same user interface and experience as most centralised exchanges offer, namely removing liquidity losses for LPs, improving the settlement efficiency of transactions for traders, and overall reducing the associated costs with both spot and perpetuals trading on the platform. In addition to this, the V2 upgrade promises the following features:

- Faster execution times and lowered slippage: Thanks to the incorporation of Chainlink’s low-latency oracles (explored below), the transaction efficiency has been greatly improved.

- Low-fee swaps: The swap fee is now competitive with the market rates of centralised exchanges (ranging from 0.05% to 0.07%).

- New assets available for trading: The newly added assets include SOL, XRP, LTC, DOGE, & ARB on Arbitrum and SOL, XRP, LTC, and DOGE on Avalanche with the potential of adding more assets in the v2 markets in the future.

There are four areas in which GMX V2 really shines and provides a competitive advantage to users over CEXes. Let’s go over what they are, below.

Before I begin, I must preface that one of the biggest benefits of trading on GMX is the ability to self-custody own assets without having to compromise on decentralisation - which is usually the case with most CEXes.

Integrating Chainlink’s Low-Latency Oracle Solution

The GMX community integrates with Chainlink’s low-latency oracles, better known as Chainlink Data Streams, for financial market data. These oracles are based on high-speed data providers that help deliver high-frequency pricing data for derivatives exchanges and applications on blockchains. This solution helps provide an ultra-low latency per-block updating of data, protecting against users’ potential losses to MEV or other arbitrageurs, among others. This, in turn, also helps support much more efficient settlements of transactions on the exchange, thereby offering a highly reliable platform for trading perpetual.

This solution is so good that GMX governance decided it was worth paying 1.2% of user fees to Chainlink node ops and $LINK stakers in order to gain access to it.

Reducing Slippage

GMX is able to reduce the slippage (to almost zero) on its platform thanks to its reliance on the GLP pool in combination with dynamic oracle price feeds provided by Chainlink. Since this perpetual exchange doesn’t rely on the traditional AMM model, LPs do not suffer from any Impermanent Loss (IL) either.

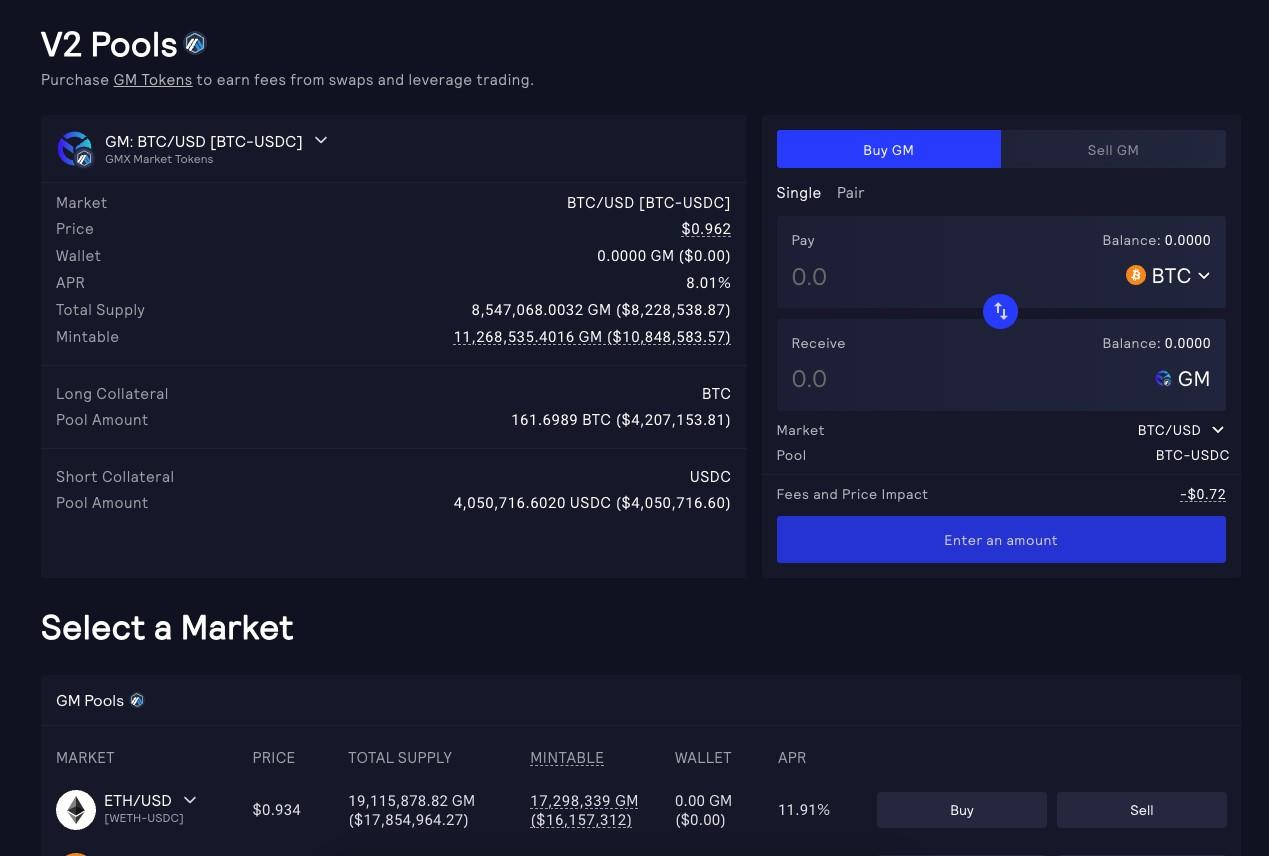

Providing Liquidity on GMX V2

In V2, a GMX market pool (also known as a GM pool) consists of:

- Index Price Feed: Long/short tokens are opened/closed based on this price feed.

- Long token: Token that backs long positions

- Short token: Token that backs short positions

Let’s understand this through an example. Suppose there is a market, ETH/USDC. The long positions in this market are backed by ETH and the short positions are backed by USDC.

These GM tokens can be bought on the pools page here. Remember to have the native network token (ETH/AVAX depending on the network you are trading on) to complete the transaction.

The price of these GM tokens is a factor of the price of the long/short tokens and the pending profit-and-loss of existing traders’ open positions on the protocol. This price increases as fees accrue from trading and swaps. While the protocol has taken concerted efforts to minimize the risks associated with perp trading, there are some that might still persist such as smart contract risks, or counterparty risks (which are still minimized via the funding rate mechanism).

Trading on GMX V2

Users can trade various assets (as mentioned above) thanks to the V2 upgrade. Users can deposit various types of collateral for their leveraged positions depending on the market. For instance, for the ETH-USDC market, users can long ETH with ETH or USDC as collateral (and the same if they wish to short). Users can also set predefined limit and/or stop-loss/take-profit orders.

The V2 upgrade currently supports two types of markets:

- Fully backed markets: An example of this is an ETH perpetual market where the open interest is limited to be lesser than the total amount of ETH and USDC tokens in that pool. This ensures that all profits are fully backed.

- Synthetic markets: Suppose a perp market for a lesser-known but highly liquid altcoin (such as DOGE) is backed by ETH-USDC. In this case, while the open interest would be limited, there is a possibility that the price of the altcoin rises exponentially which imbalances the amount of profits that need to be paid out with the underlying ETH-USDC pool. To avoid such a scenario, GMX incorporates ADL (Auto-Deleveraging) which closes profitable positions when a configured profit threshold for that market is reached.

Fees on GMX V2

If the trade increases the balance of tokens in the pool, the fee is

- 0.05% of the trade amount.

However, if the trade decreases the balance of tokens in the pool, the fee is

- 0.07% of the trade amount.

Similarly, for stablecoin swaps, if the trade increases the balance of stablecoin pool tokens, the fee is

- 0.005% of the trade amount.

However, if the trade doesn’t increase the balance of stablecoin pool tokens, the fee is

- 0.007% of the trade amount.

There is also a borrowing fee for open positions which varies depending on whether there are more longs than shorts (where those with long positions pay the borrowing fee) and vice versa.

Security and Audits for GMX V2

The V2 smart contracts have been audited and details can be found here.

GMX DeFi Penetration

There are 28+ projects that are currently being built atop GMX, several of which include vaults, lending, options, social trading, and more!

STIP Grants

For those of you who are still around and paying attention, you may have seen that Arbitrum had a huge proposal that passed. This proposal was for a Short Term Incentive Program where the Arbitrum DAO will give 50M ARB tokens to active protocols within the community.

Each project either themselves or through the help of their community created their own proposal to be eligible for these rewards and the ones with the most votes would win a portion of the rewards in proportion.

29 protocols out of the 97 that took part were eligible for some rewards.

The largest chunk, of course, goes to one of the biggest and best on Aritrum, GMX.

GMX bagged around 12M ARB which equates to just around $10M. These funds are expected to be allocated to protocol incentives which means GMX stakers and GLP holders can expect some boosted yields in the short term.

What this STIP also does is bring users to Arbitrum. Now that all the hungry degens know that 50M ARB tokens have been allocated to many different protocols, they will be doing their bit to capture some of those extra incentives.

So extra incentive money + more users to Arbitrum + GMX V2 being just around the corner, you tell me how that doesn’t equate to a potential monster season coming up for GMX and Arbitrum in general?

Closing Thoughts

Most spot and perpetual DEXes today are already leading the race thanks to their ability to provide non-custodial trading opportunities for their users. This cuts down extensively on KYC-related restrictions and also helps circumvent legal ambiguity surrounding most exchanges. GMX is certainly leading that race with its approximate $6M+ in daily trading volume.

One of the core objectives of the GMX exchange has been to put incessant focus on UI and offer a much smoother UX to its users. This - coupled with its ability to remain chain agnostic - renders it a highly favourable and promising position in the market (even the likes of Blocktower have a position on GMX worth $370K!)

It would be worth watching the protocol unfold and grow in the next few months with its V2 upgrade.

.png)